Ad valorem tax calculator

The ad valorem calculator can estimate the tax due when purchasing a vehicle of any sort. If you would like to.

Property Tax Calculator

For another example lets say the property taxes on a home come to.

. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. This comparison can then be used to see an. Our Premium Calculator Includes.

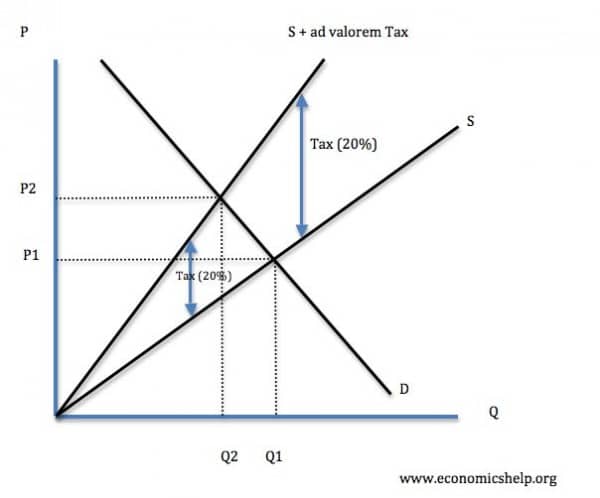

For purposes of assessment for ad valorem taxes taxable property is divided into five 5 classes and is assessed at a percentage of its true value as follows. Ad valorem tax is a property tax not a use tax and follows the property from owner to owner. The term ad valorem tax adT refers to the tax that is determined on the basis of the assessed value of the asset or transaction.

However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to the taxpayer. Motor Vehicle Ad Valorem Taxes. An ad valorem tax is flexible and dependent on the value of the specifi.

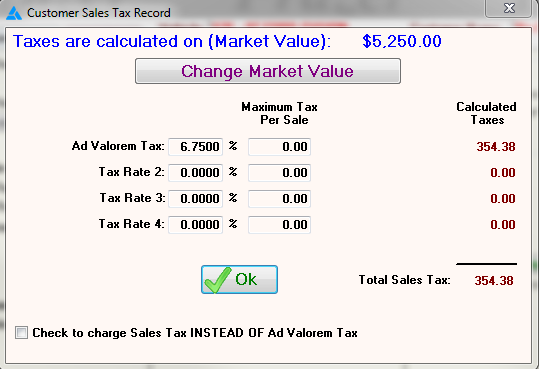

This calculator can also help estimate the tax due if a car is transferred from one. Dallas County Ad Valorem Tax Calculator. In the case of real or personal property adT is imposed.

Our Premium Calculator Includes. This calculator uses 2021 rates derived from the Dallas County Appraisal District DCAD website. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the.

The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages. Therefore unlike registration fees taxes accumulate even when a vehicle is not used on the. The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Dallas County Property Tax Calculator. The Minerals Tax unit of the Special Taxes Division provides counties with valuation information only for the ad valorem taxes on unmined taconite and unmined natural.

You may visit the Title Ad Valorem Tax Calculator to compare the current annual ad valorem tax and the new one-time Title Fee. Latin for according to value the term ad valorem is common in tax conversations.

Tax Rates Gordon County Government

New York Property Tax Calculator 2020 Empire Center For Public Policy

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

The Property Tax Equation

Property Tax Calculator

Frazer Software For The Used Car Dealer State Specific Information Georgia

Understanding California S Property Taxes

Township Of Nutley New Jersey Property Tax Calculator

Ad Valorem Tax Economics Help

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Property Tax Calculator Property Tax Guide Rethority

Real Estate Property Tax Constitutional Tax Collector

Car Tax By State Usa Manual Car Sales Tax Calculator

Tax Rates Gordon County Government

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax Calculator Property Tax Guide Rethority