Mortgage calculator with annual lump sum payments

Mortgage Amount or current balance. But like many personal finance decisions its a matter of choosing between a good option and a better option.

Downloadable Free Mortgage Calculator Tool

Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. While most homeowners only make 12 payments annually you can make a lump sum payment equivalent to a 13th payment on your mortgage. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

Exposure to Stock Market Downturns. Our mortgage calculator supports four types of extra payments one-time lump sum payments recurring monthly quarterly or yearly extra payments. Paying down debt is rarely a bad idea.

According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. Annual or monthly payments paid to you and potentially to your spouse if there is a survivor benefit for life. When a Lump-Sum Payment Makes Sense.

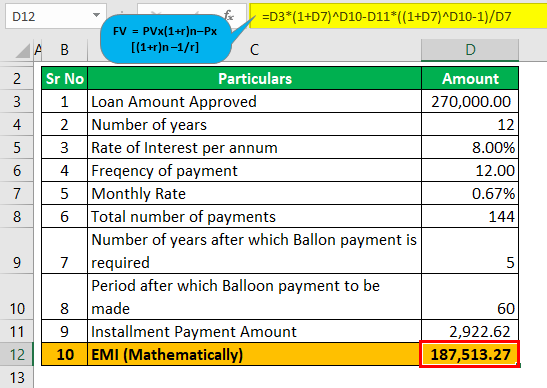

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. In most cases the lump-sum option is clearly the way to go. This adds 5500 to your monthly payments.

If you want to make a lump sum extra payment of 1000 enter it and change the Monthly to One Time for an accurate calculation. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to. This is the best option if you plan on using the calculator many times over the.

And if the bankruptcy of your company is a concern the Pension Benefit. LOWER The payments are not impacted by market downturns. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

Your mortgage can require. Private Mortgage Insurance also known as Lenders Mortgage Insurance tends to be around 55 per month per 10000000 financed. The main difference between a lump-sum and a monthly payment is that with a lump-sum option you get to have control over how your money is invested and what happens to it once youre gone.

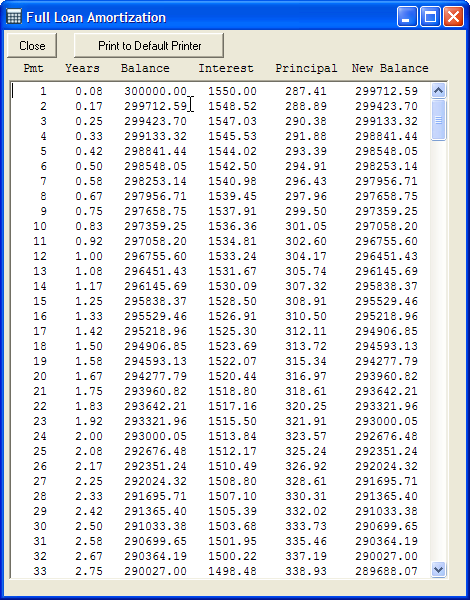

Annual Lump Sum Equal to a 13th Payment. The mortgage amortization schedule shows how much in principal and interest is paid over time. To get the most accurate mortgage report enter as many relevant fields as possible.

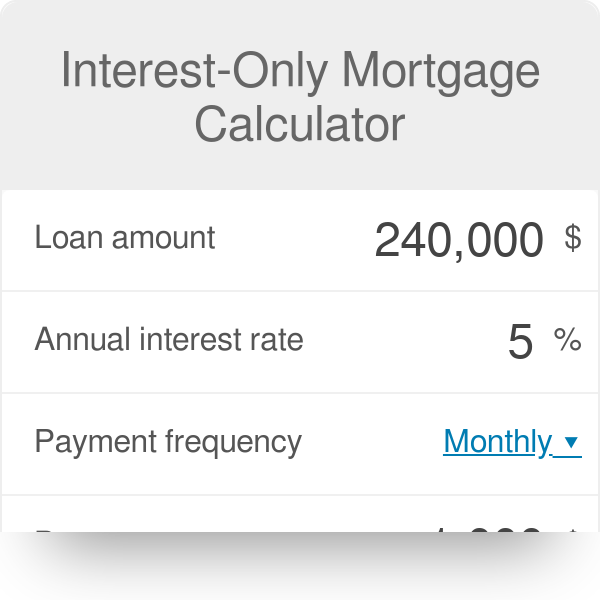

A large one-time upfront payment to you. Enter the loans interest rate if it doesnt come with any fees under Interest rateNote that your monthly mortgage payments will vary depending on your interest rate taxes PMI costs and other related fees. Make more frequent payments.

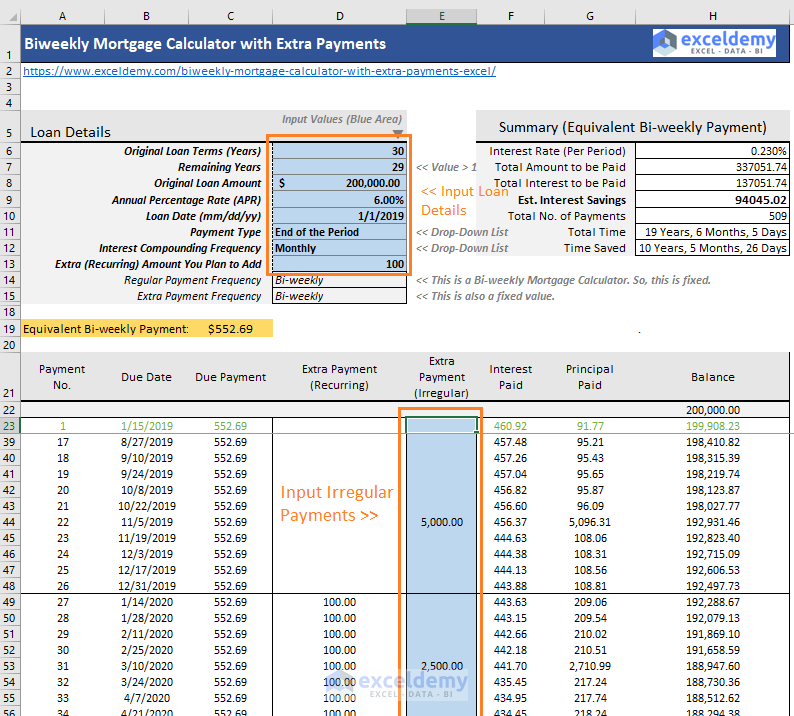

Biweekly monthly quarterly or annual payments along with one-off lump sum contributions. Is approaching 400000 and interest rates are hovering around 3. Taking advantage of particular prepayment privileges that some mortgage lenders offer such as RBCs Double-Up prepayment option or BMOs 20 annual lump-sum prepayment option will also reduce your amortization period.

When you use this service youll see all the information you need including your remaining annual allowance. Recurring extra payments add up to reduce your principal balance. If you do this each year you can significantly reduce your term and interest charges.

Found on the Set Dates or XPmts tab. First Payment Due - due date for the first payment. In a year you might receive lump sum payments in the form of an annual work bonus or a windfall from a business venture.

Here are some ways to know whether making a lump-sum mortgage payment is the best option for you. Make Lump Sum Loan Payments. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments.

30-Year Fixed Mortgage Principal Loan Amount. Using our mortgage rate calculator with PMI taxes and insurance. Make sure you enter the frequency of contribution you would like to make when the contribution begins and.

Once you click compute youll see how much the extra mortgage payments will save in the way of interest over the life of the loan and also how much faster youll pay off your mortgage. You can make a lump sum payment once a year. See how those payments break down over your loan term with our amortization calculator.

But if you have large funds you can use it to decrease a considerable portion of your loan. This is the best option if you are in a rush andor only plan on using the calculator today. Mortgage Closing Date - also called the loan origination date or start date.

Fortunately these annual payment fluctuations will probably be minor relative to an ARMs interest rate resetting or an interest-only period ending. Whatever the frequency your future self will thank you. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. Interest rate is the annual interest rate of your mortgage loan given in percentage. You can typically elect to begin making the higher mortgage payment to cover the shortfall or pay a lump sum to boost your escrow account reserves so your monthly payment wont change.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. You can check the current mortgage rates here.

Enter how much you want to borrow under Loan amount. Most banks offer some form of mortgage payment deferral to help homeowners during difficult financial periods. If thats the case then the lump-sum option is your best bet.

About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. Underneath the sub menu My payments choose the make a payment Overpayment missed mortgage payment or manual mortgage payment option and select lump sum overpayment. You can also use the calculator on top to estimate extra payments you make once a year.

Just select My payments and services from the main menu. Type in your mortgage term in years not months under the Loan terms field. You can even combine multiple extra payments in a single calculation.

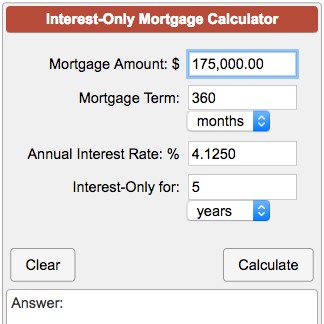

Interest Only Mortgage Calculator

Extra Payment Mortgage Calculator For Excel

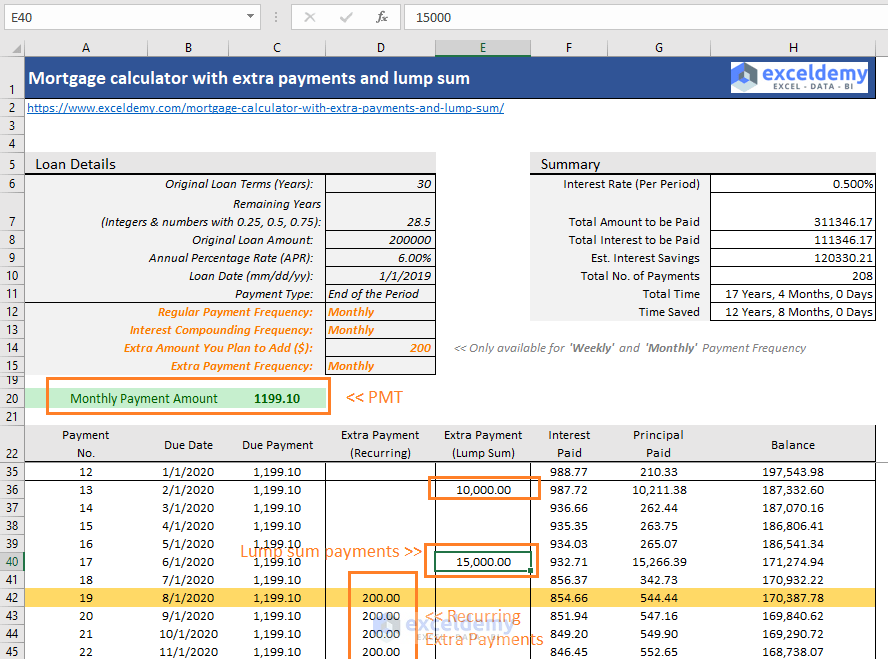

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments Payment Schedule

Mortgage Calculator Money

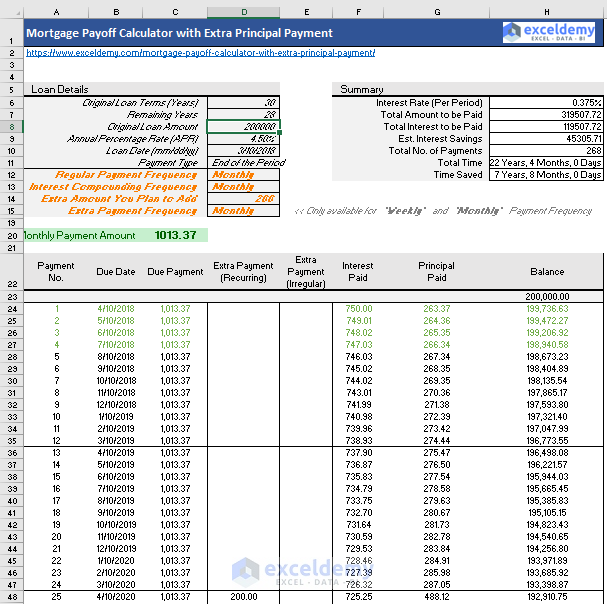

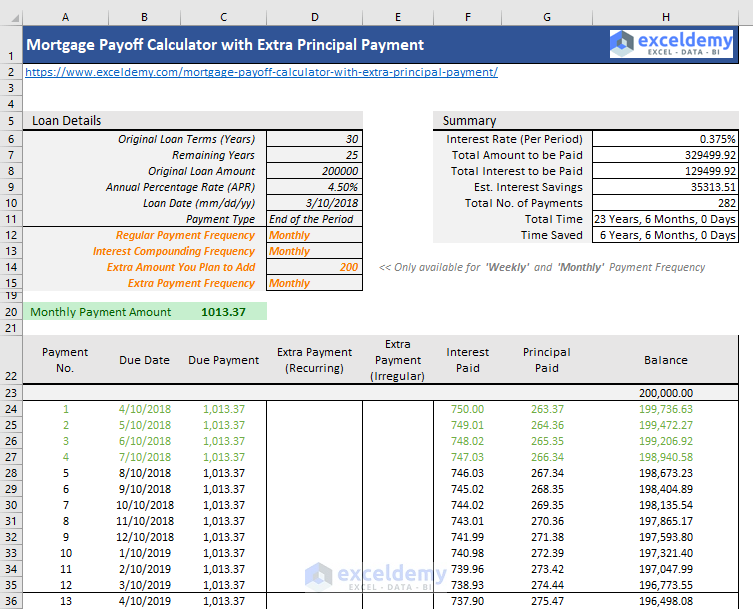

Mortgage Payoff Calculator With Extra Principal Payment Free Template

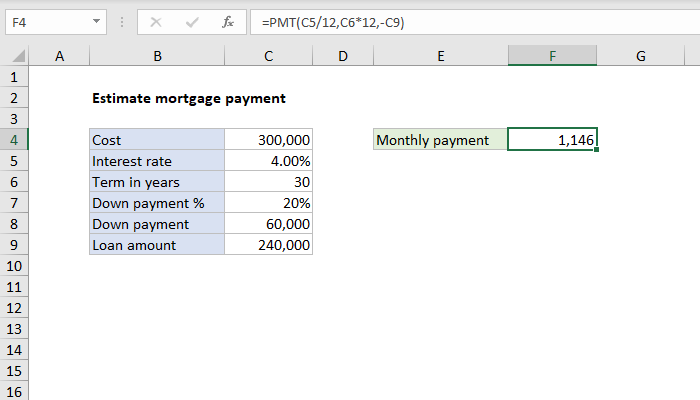

Excel Formula Estimate Mortgage Payment Exceljet

Mortgage Calculator Joan Killian Everett Company North Carolina Real Estate

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Interest Only Mortgage Calculator

Downloadable Free Mortgage Calculator Tool